A quick introduction for creating and resolving your first Alias.

Create an account on Visa Developer and add Alias Directory to your project. Click this link for an example of creating a project and adding APIs.

Connect to the Create Alias API in the Sandbox. Use the below code in your Create Alias API request body. Please fill the alias Value prior to submitting the request.

{

"aliasValue": "{CREATE YOUR OWN VALUE HERE}",

"aliasType": "PHONE",

"profile": {

"firstName": "John",

"lastName": "D"

},

"consent": {

"presenter": "Bank A",

"validFromDateTime": "2022-03-30T04:43:22.043Z",

"expiryDateTime": "2022-06-20T10:00:00Z",

"version": "1.0"

},

"paymentCredentials": [

{

"type": "CARD",

"preferredFor": [

{

"type": "RECEIVE"

}

],

"nameOnCard": "John Doe",

"accountNumber": "4000000000000000",

"expirationDate": "2030-01",

"billingAddress": {

"addressLine1": "100 Main Street",

"addressLine2": "Suite 101",

"city": "San Francisco",

"postalCode": "94105",

"state": "CA",

"country": "USA"

}

}

]

}

You should receive a successful response like the below. The phone number and card are now linked.

{

"id": "df844b33-0712-4783-9f84-55d5d90eb2df",

"paymentCredentials": [

{

"type": "CARD",

"id": "752c1fc5-b13b-4903-a725-090601d26f22"

}

]

}

Now use the Resolve API to retrieve the payment credential. Use the below code in the Resolve API request body.

{

"aliasValue": "{USE PHONE NUMBER FROM PREVIOUS STEP}",

"aliasType": "PHONE"

}

You should now be able to see the details associated with the Alias in the response.

{

"identification": {},

"profile": {

"firstName": "John",

"lastName": "D"

},

"paymentCredentials": [

{

"type": "CARD",

"accountNumber": "4000000000000000",

"preferredOn": "2022-10-24T19:35:34.654487Z",

"nameOnCard": "John Doe",

"expirationDate": "2030-01",

"billingAddress": {

"city": "San Francisco",

"country": "USA",

"addressLine1": "100 Main Street",

"state": "CA",

"postalCode": "94105",

"addressLine2": "Suite 101"

}

}

],

"directoryName": "STANDARD_91D614C3"

}

Delete please

Create an additional Alias for the one created in step 2. The previously created Alias will be the primary Alias, and the one created below will be the secondary Alias. An additional Alias is generated by passing the Alias ID of the primary Alias in the path parameters (752c1fc5-b13b-4903-a725-090601d26f22 in the above example)

{

"type": "EMAIL",

"value": "[email protected]"

}

Resolving the alias 'johndoe@gmail.com' should return similar details like those in step 3

Alias Directory allows clients to create Aliases and manage their lifecycle, e.g., update and delete.

| Key Terms | Definitions |

|---|---|

| Participants |

|

| Alias |

|

| Profile |

|

| Payment Credential |

|

| Program |

|

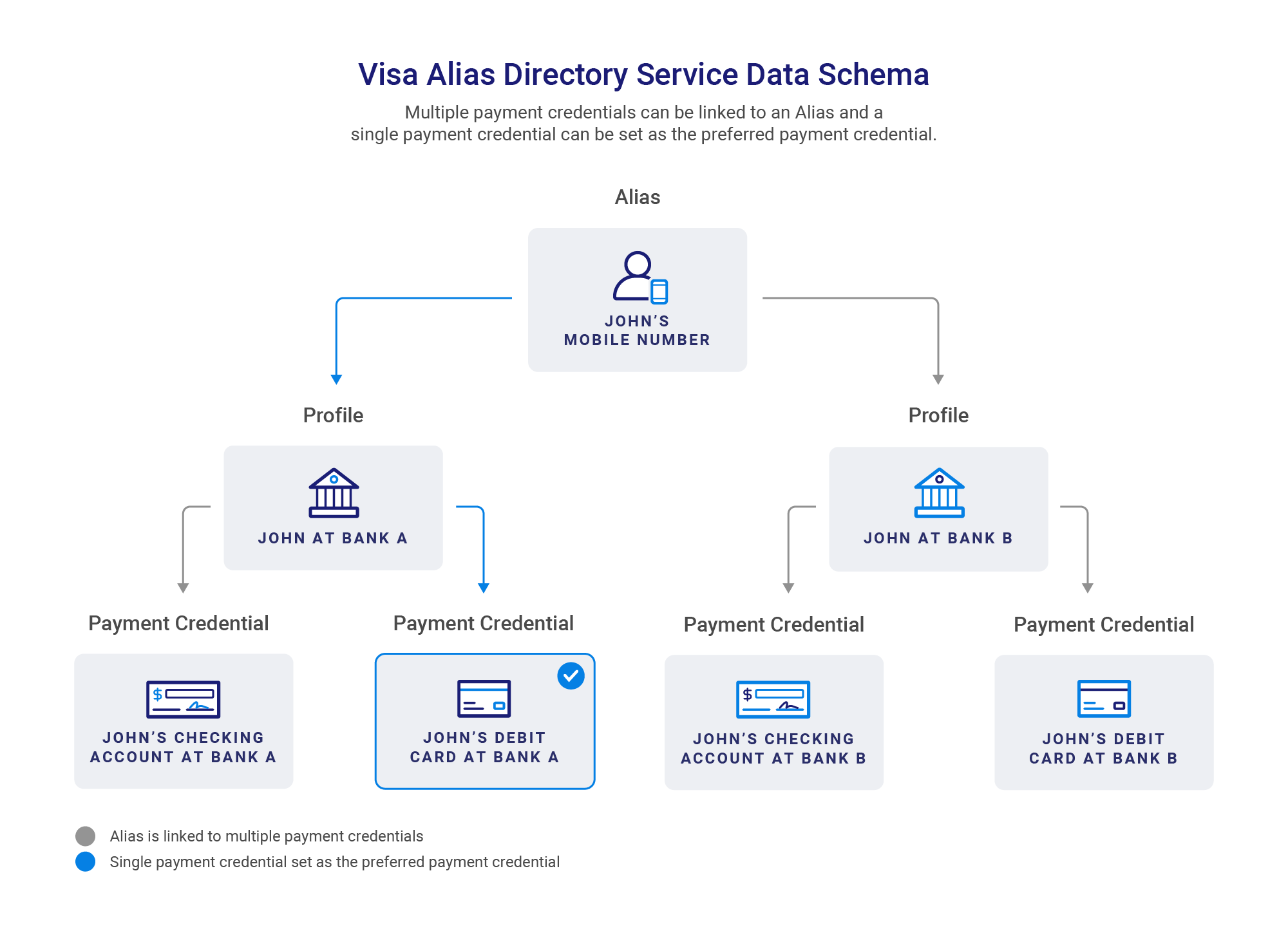

The below diagram is a simple visual of how this data is mapped in Alias Directory. In the below example

API |

Description |

|---|---|

Create Alias |

Visa+ payname format: “+payname.domain" [must be min 4 and max 49 characters] Prefix '+' : Consumers of Visa+ APIs must send all paynames with the ‘+’ sign as the first position of the field. Payname : Can be defined by the Consumer or suggested by the Participant. Delimiter '.' : Separates Visa+ payname from the domain Domain : Participant on the receive side selects the domain during the enrollment process Allowed characters: Accented: é - accent acute, è - accent grave, ê – circumflex, ë - umlaut or diaerisis, ç – cedilla, ñ – tilde, ø – streg, ð - eth (capital form Ð), å – bolle, æ – ligature, œ – ligature, ē – macron, č – háček, ŭ – crescent Special characters: Dot / period, Comma, Hyphen, Apostrophes (of the N and the ’ variety), Spaces, Underscore |

Create Additional Alias |

|

Update Alias |

|

Delete Alias |

|

Create Payment Credential |

|

Get All Payment Credentials |

|

Get Payment Credential |

|

Update Payment Credential |

|

Delete Payment Credential |

|

Possible Alias statuses:

Status |

Comments |

|---|---|

Active |

|

Deleted |

|

Blocked |

|

Disabled |

|

| Expired |

|

Possible Payment Credential statuses:

Status |

Comments |

|---|---|

Active |

|

Deleted |

|

| Blocked |

|

| Disabled |

|

| Expired |

|

Overview

Alias Directory offers clients a number of options for managing their Alias records. Clients may already have an existing id used for their consumer's Alias data and can reuse that id as an externalId.

In the Create Alias call, an id; is returned for the Alias (Line 2) and for each payment credential (Line 6 & 12). Each id is internally generated by Alias Directory and used for identifying each record. Clients can provide an externalId during the Create Alias API and each externalId will be associated with an internal id

In the below example, the externalId is returned in Lines 3,8, and 13.

{

"id": "0ddaa171-5247-424a-a562-40788940c5cf",

"externalId": "ec66fd21-a328-4943-bb0d-c011b27553b5",

"paymentCredentials": [

{

"type": "CARD",

"id": "6ef14e04-6d0d-4ec7-b14b-335a46ae45e4",

"externalId": "0e1d1bdf-11a6-4fa9-bd8d-687c465f7bec"

},

{

"type": "BANK",

"id": "e6782b9b-0dc8-4669-a5f4-394519e49986",

"externalId": "4f8b8823-230b-4ffb-b57b-72300ceec150"

}

]

}

Retrieving Internal IDs using External IDs

To perform lifecycle management, clients must use the internal id. If the client is only storing the externalId, the clients must first retrieve the internal id by calling the Get By External ID API and including externalId in the request. See below request example:

{

"type":"ALIAS",

"externalId":"ec66fd21-a328-4943-bb0d-c011b27553b5"

}

The response returns the internal id, which can then be used for lifecycle management. See below response example.

Retrieving Internal IDs using Alias

Clients can also retrieve the internal id of an Alias using the Alias value itself. This can be done via the Get Alias Id From Value API. See below a sample request:

{

"aliasValue": "6886217206"

}

The response will include the id of the Alias.

{

"id": "0ddaa171-5247-424a-a562-40788940c5cf"

}

There are two APIs within the Alias Resolution bundle

Alias Resolution - Retrieve information about an Alias and the payment credential(s) associated with the Alias.

Alias Inquiry - Enables clients to check if an Alias or list of Aliases is available for Alias resolution. The response will indicate the Aliases that are available for Alias resolution.

Alias Directory currently supports the following Alias types: Phone, Email, Directory_AliasID.

Directory_AliasID is a unique identifier which is associated with an Alias. This is used by some wallets in certain markets. For example, in the Peru market, the Directory_AliasID is derived from a QR code, which is associated with an Alias in a particular wallet.Alias Directory supports a number of filters which can be applied to the Alias Resolution request.

Directory_Name - Send Alias Resolution to only this directoryExcluded_Directory_Name - Exclude this directory in the Alias ResolutionEntity_ID - The entity Id is used to identify the specific participant that created an Alias record. In the local directory, the entity ID is the participant who created the Alias record in the local directory. For remote directories, the entity Id is used by some remote directories to identify the entities within their directory. For example, a remote directory may have multiple banks within its directory. The Alias Resolution request can be sent to a specific bank within that remote directory by using that bank’s entity ID.

{

"summary": {

"aliasesTotal": 1,

"aliasesFound": 1,

"aliasesNotFound": 0,

"aliasesRepeated": 0

},

"details": [{

"directoriesName": ["STANDARD_VISA"],

"directories": [{

"directoryName": "STANDARD_VISA",

"entities": [{

"id": "593f1c3b-73f8-4379-9a82-94f8af407173",

"preferredFor": [{

"type": "RECEIVE",

"date": "2024-08-13T05:23:47.985Z"

}]

}]

}],

"aliasValue": "411223344555",

"aliasType": "PHONE"

}]

}

currencyCode - Allows a client to specify the currency of the payment credential returned in the Alias Resolution response. Some clients have different payment credentials for different currencies. By providing the currencyCode, a client can specify currency of the payment credential needed in the Alias Resolution response. Rule Name |

Description |

|---|---|

Preferred Payment Credential |

|

Preferred Payment Credential Timestamp |

|

Phone |

Participant |

Marked as Preferred? |

Preferred Timestamp |

|---|---|---|---|

6505001234 |

Bank A (Local Directory) |

Yes |

1:00 pm, June 1, 2023 |

6505001234 |

Bank B (Remote Directory) |

Yes |

4:00 pm, June 10, 2023 |

6505001234 |

Bank C (Local Directory) |

No |

|

Given the above example, Alias Resolution would return Bank B’s Payment Credential.

Integration with Cybersource Token Management Service

Alias Directory Service supports tokenization for payment instruments through an integration with Cybersource Token Management Service. Token Management Service (TMS) creates a network token, which Alias Directory stores and associates with an Alias. The token protects sensitive customer payment data stored in secure Visa data centers and can be used in place of a PAN in an OCT.

Alias Directory currently uses TMS for tokenizing Visa payment credentials.

Please visit this link to learn more about Cybersource Token Management Service https://developer.cybersource.com/docs/cybs/en-us/tms/developer/ctv/rest/tms/tms-overview.html

Local Directory Tokenization

Remote Directory Tokenization

This section details the case where a Remote Directory is providing a payment instrument to Alias Directory Service for use in Alias Resolve.

Non-PCI Compliance and Tokenization

Clients who are configured as non-PCI compliant are now supported through the use of tokenization.

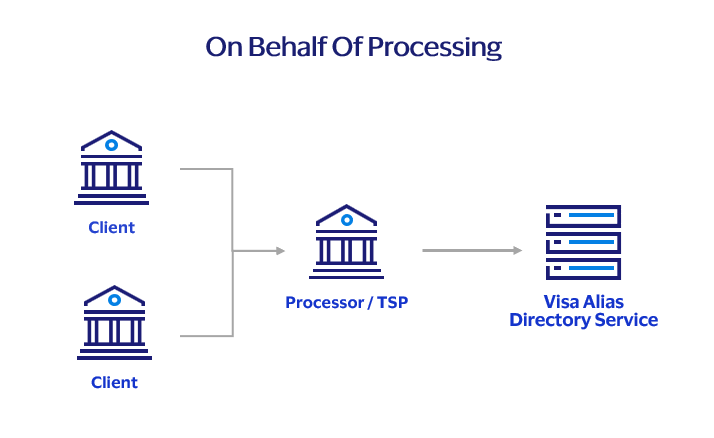

On-Behalf-Of processing allows processors, or technical service providers (TSPs) to enable the Visa Alias Directory Service for multiple clients using a single project on Visa Developer Center.

When Visa Alias Directory receives an API call with the On-Behalf-Of header, it will process the API call as if received from the client identified by that header.

It is important to include the correct participant ID in the On-Behalf-Of header as this ensures Visa Alias Directory processes the request correctly:

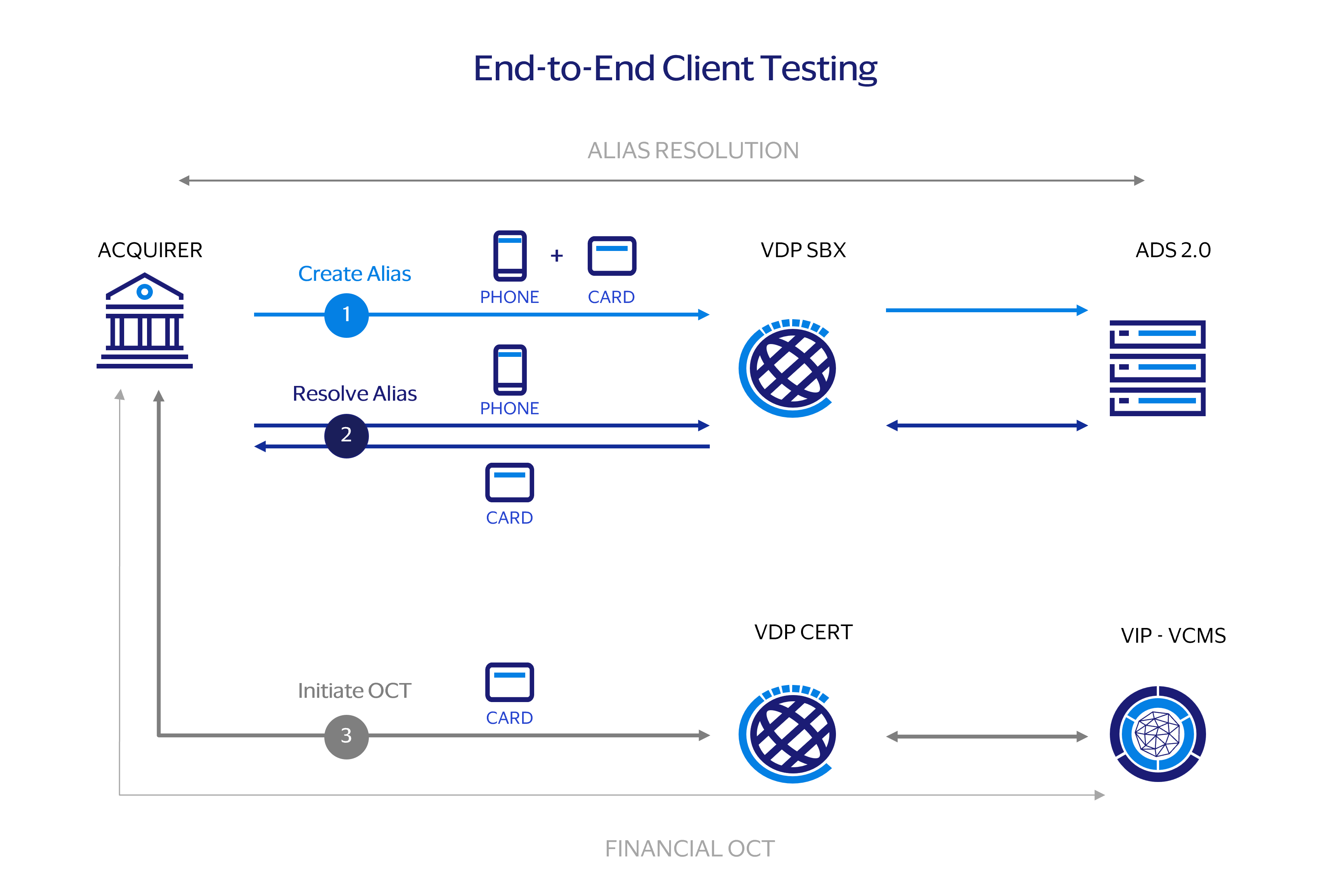

This section provided detailed instruction for testing OCTs in VCMS with Alias Directory. Please follow the following steps for end-to-end testing:

Alias Directory Service provides APIs for requesting and downloading reports. The available endpoints are listed below

Client

Create a report request

Visa

Return report ID

Client

Check report status

Client

Download completed report

Step |

Endpoint |

Description |

Additional Details |

|---|---|---|---|

Create Report |

/reports (POST) |

Create a report, specify the report type and define the parameters.

|

The field type specifies the type of report to be generated

The field filters defines the parameters used to create the report (e.g., startDate, endDate) Alias Directory will create the report offline and clients can download in the subsequent steps. |

Get Report |

/reports/{reportId} (GET) |

Retrieves information about a specific Create Report request. |

Clients can use this endpoint to check the status of a Create Report request. For example, the create report request may be “completed” or “in-progress” The response of this will also include the field "fileIds". The fileId will be used to download the report. Please note some reports may have multiple files due to the size of the report.

|

Download Report |

/reports/{reportId}/file/{fileId} (GET) |

Retrieves a file from a previously requested report with COMPLETED status. |

This endpoint returns the requested data in JSON format, as described in the API spec, as part of the MLE encrypted response payload. |

Report Description:

Report Fields:

Field Name: originationDateTime

Description: The date and time of the Alias Resolution request

Example: 2021-01-01T10:52:46.000Z

Field Name: programId

Description: The guid of the program that the participant belongs in

Example: a5d0bd35-16f5-4e98-86f5-b1a464215a63

Field Name: originatorActorId

Description: Participant id of the entity which sent the request

Example: 6ac54662-84da-401d-aab5-b86bac9a02a0

Field Name: onBehalfOf

Description: Participant id which the original_actor_id sent the request on behalf of. This is only applicable in certain cases.

Example: 1ff54662-84da-401d-aab5-b86bac9a02a2

Field Name: resolvedAlias

Description: The Alias value provided in the Alias Resolution request

Example: 123456789

Field Name: resolvedPaymentCredentialType

Description: The type of payment credential returned in the Alias Resolution response

Example: CARD

Field Name: statusCode

Description: The status code returned in the API response

Example: 200

Field Name: resolvedDirectory

Description: The name of the directory which returned the payment credential

Example: Directory A

Report Sample

[

{

"originationDateTime": "2023-07-31T20:15:18.679Z",

"programId": "baf85624-3cf6-4c52-b91f-b8f3493e7330",

"originatorActorId": "012af73f-44d8-4c9c-bbee-628b07faae1c",

"statusCode": 200

},

{

"originationDateTime": "2023-07-31T20:23:49.618Z",

"programId": "baf85624-3cf6-4c52-b91f-b8f3493e7330",

"originatorActorId": "012af73f-44d8-4c9c-bbee-628b07faae1c",

"statusCode": 200

}

]

Report Description:

Report Fields:

Field Name: programId

Description: The guid of the program that the participant belongs in

Example: a5d0bd35-16f5-4e98-86f5-b1a464215a63

Field Name: ownerParticipantId

Description: The participant id which owns this Alias and payment credential information

Example: 6ac54662-84da-401d-aab5-b86bac9a02a0

Field Name: objectType

Description: The type of this object

Possible values: ALIAS, PAYMENT_CREDENTIAL

Field Name: objectSubType

Description: The sub_type of this object

Possible values:

For Object_Type = ALIAS, then possible subtypes are: PHONE, EMAIL

For Object_Type = PAYMENT_CREDENTIAL, then possible subtypes are: CARD, BANK

Field Name: status

Description: The status of this object

Possible values: ACTIVE, DISABLED, BLOCKED, DELETED

Field Name: objectCount

Description: The number of types this object is in the Alias Directory

Example: 1200

Report Sample

[

{

"programId": "c0af8887-eac3-4b89-ad35-73c66e22088e",

"ownerParticipantId": "d1ebd0da-54e5-493a-9ba3-4ccc21a183cc",

"objectType": "ALIAS",

"objectSubType": "PHONE",

"status": "ACTIVE",

"objectCount": 763739

},

{

"programId": "c0af8887-eac3-4b89-ad35-73c66e22088e",

"ownerParticipantId": "d1ebd0da-54e5-493a-9ba3-4ccc21a183cc",

"objectType": "ALIAS",

"objectSubType": "BANK",

"status": "ACTIVE",

"objectCount": 8772470

}

]

Report Description:

Report Fields:

Field Name: paymentCredentialCreatedDateTime

Description: The time the payment credential was created

Example: 2021-01-01T10:52:46.000Z

Field Name: programId

Description: The guid of the program that the participant belongs in

Example: a5d0bd35-16f5-4e98-86f5-b1a464215a63

Field Name: ownerParticipantId

Description: Participant id which created the payment credential

Example: 9ed54662-84da-401d-aab5-b86bac9a02a0

Field Name: paymentCredentialId

Description: The internal ID of the payment credential

Example: 40f26d01-28b8-4261-8d9d-638e2bade69c

Field Name: paymentCredentialType

Description: The type of the payment credential

Example: CARD

Field Name: accountNumberLast4

Description: The last four digits of the account

Example: 3456

Field Name: paymentCredentialStatus

Description: The status of the payment credential

Example: ACTIVE

Field Name: aliasId

Description: The internal ID of the Alias associated with this payment credential

Example: daa3ceaa-c3d5-4b3c-b03e-9bc1eed60b78

Field Name: aliasValue

Description: The value of the Alias associated with this payment credential

Example: 51991512051

Field Name: aliasType

Description: The type of Alias

Example: Phone

Report Sample

[

{

"paymentCredentialCreatedDateTime": "2023-07-31T20:06:01.654426Z",

"programId": "baf85624-3cf6-4c52-b91f-b8f3493e7330",

"ownerParticipantId": "012af73f-44d8-4c9c-bbee-628b07faae1c",

"paymentCredentialId": "06eeb39a-696a-4c6a-84f8-f3b2ad27ca11",

"paymentCredentialType": "BANK",

"accountNumberLast4": "1140",

"paymentCredentialStatus": "ACTIVE",

"aliasId": "967a3033-5cd3-4fe1-b09f-b6e4f1da5855",

"aliasValue": "7568893885",

"aliasType": "PHONE"

},

{

"paymentCredentialCreatedDateTime": "2023-07-31T20:10:43.339798Z",

"programId": "baf85624-3cf6-4c52-b91f-b8f3493e7330",

"ownerParticipantId": "012af73f-44d8-4c9c-bbee-628b07faae1c",

"paymentCredentialId": "1693aa4c-cb16-42ca-afa5-f0b6d6f75aeb",

"paymentCredentialType": "BANK",

"accountNumberLast4": "1140",

"paymentCredentialStatus": "ACTIVE",

"aliasId": "9564fb2a-c19c-4082-a973-c5233e5b0f24",

"aliasValue": "9049748451",

"aliasType": "PHONE"

}

]

Report Description:

Report Fields:

Field Name: programId

Description: The guid of the program that the participant belongs in

Example: a5d0bd35-16f5-4e98-86f5-b1a464215a63

Field Name: originatorActorId

Description: Participant id of the entity which sent the request

Example: 6ac54662-84da-401d-aab5-b86bac9a02a0

Field Name: onBehalfOf

Description: Participant id which the original_actor_id sent the request on behalf of. This is only applicable in certain cases.

Example: 1ff54662-84da-401d-aab5-b86bac9a02a2

Field Name: operationType

Description: The type of operation the report must include.

Possible values:

aliasInquiry

createAlias

createBatch

createPaymentCredential

createReport

deleteAlias

deletePaymentCredential

getAlias

getAliasId

getAliasOnlineReport

getBatch

getBatchKeys

getBatchResult

getByExternalId

getPaymentCredential

getPaymentCredentials

getReport

getReportFile

resolveAlias

updateAlias

updateAliasStatus

updateBankPaymentCredential

Field Name: statusCode

Description: The status code returned in the API response

Example: 200

Field Name: operationsCount

Description: The aggregated amount of the number of requests

Example: 99

Report Sample

[

{

"programId": "baf85624-3cf6-4c52-b91f-b8f3493e7330",

"originatorActorId": "012af73f-44d8-4c9c-bbee-628b07faae1c",

"operationType": "resolveAlias",

"statusCode": 200,

"operationsCount": 18

},

{

"programId": "baf85624-3cf6-4c52-b91f-b8f3493e7330",

"originatorActorId": "012af73f-44d8-4c9c-bbee-628b07faae1c",

"operationType": "resolveAlias",

"statusCode": 422,

"operationsCount": 4

}

]

Report Description:

Report Fields:

Field Name: resolveDirectory

Description: The directory which received the Alias Resolution requests.

Example: Directory A

Field Name: programId

Description: The guid of the program that the participant belongs in

Example: a5d0bd35-16f5-4e98-86f5-b1a464215a63

Field Name: originatorActorId

Description: Participant id of the entity which sent the request

Example: 6ac54662-84da-401d-aab5-b86bac9a02a0

Field Name: onBehalfOf

Description: Participant id which the original_actor_id sent the request on behalf of. This is only applicable in certain cases.

Example: 1ff54662-84da-401d-aab5-b86bac9a02a2

Field Name: operationType

Description: The type of operation the report must include.

Possible values:

resolve_Alias

Field Name: statusCode

Description: The status code returned in the API response

Example: 200

Field Name: requestCount

Description: Total number of Alias Resolution requests

Example: 1200

Report Sample

[

{

"resolveDirectory": "STANDARD_5EF147CC",

"programId": "baf85624-3cf6-4c52-b91f-b8f3493e7330",

"originatorActorId": "012af73f-44d8-4c9c-bbee-628b07faae1c",

"operationType": "resolve_alias",

"statusCode": 422,

"requestCount": 0

},

{

"resolveDirectory": "STANDARD_GTB094FB",

"programId": "baf85624-3cf6-4c52-b91f-b8f3493e7330",

"originatorActorId": "012af73f-44d8-4c9c-bbee-628b07faae1c",

"operationType": "resolve_alias",

"statusCode": 200,

"requestCount": 0

}

]