Use Cases Disclosure: Use cases are for illustrative purposes only. Program providers are responsible for their programs and compliance with any applicable laws and regulations.

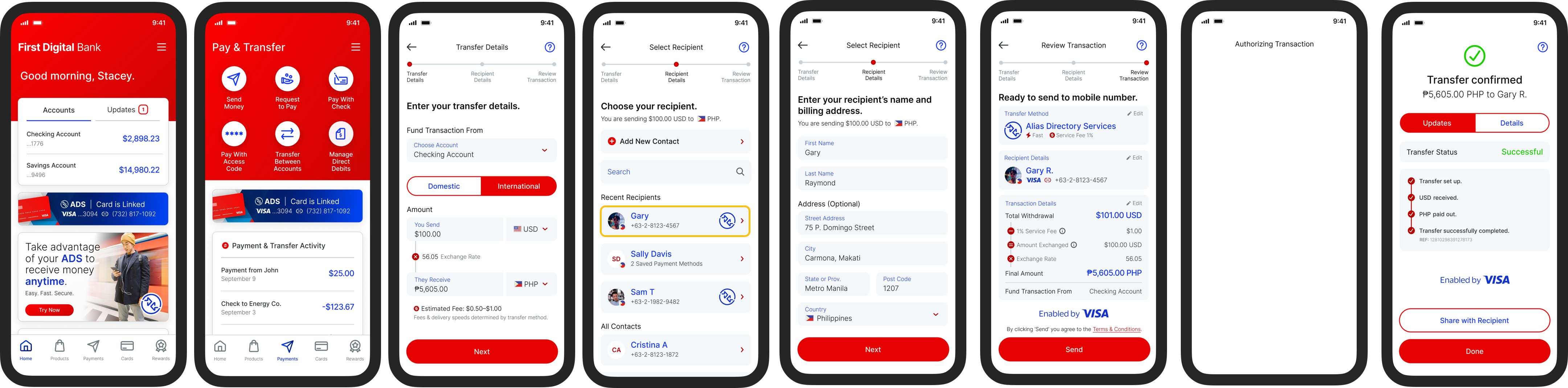

Stacey opens her mobile banking application to send money to a family member.

Stacey goes to her payments dashboard and selects “Send Money”.

Stacey selects the account that she wants to use to fund the transaction and enters the transaction amount.

Stacey is then presented with her phone contact list to select the recipient. Each contact who has registered with ADS will have the ADS icon next to their name.

She wants to send money to her Dad. So she selects his name from the contact list.

Stacey confirms the transfer details, such as checking the recipient’s name is correct.

Done! Stacey has now sent money to Gary using his phone number.

Use Cases Disclosure: Use cases are for illustrative purposes only. Program providers are responsible for their programs and compliance with any applicable laws and regulations.

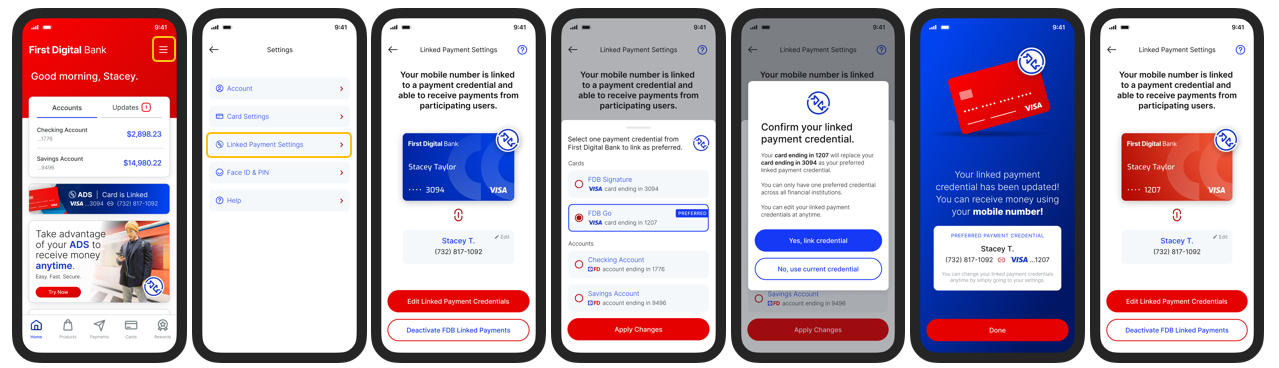

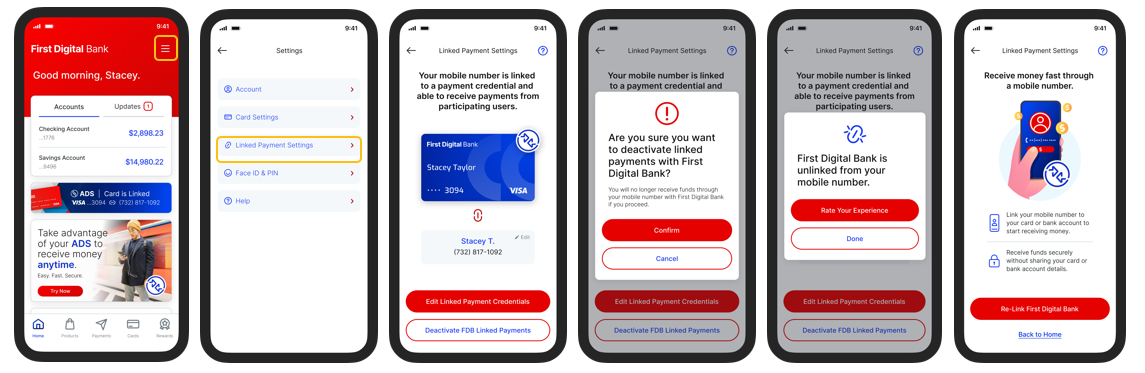

Stacey opens her mobile banking application to update her Alias profile.

Stacey goes to "Linked Payment Settings" where she can manage her current Preferred Payment Credential.

She selects the button to Deactivate her Alias profile.

Stacey confirms the deactivation of the Alias profile .

Stacey’s Alias profile is now removed. Stacey can re-activate her profile easily again in the future.

Ukraine

Many markets in Eastern Europe, Caucasus, and Central Asia have become advocates of the digital economy and work to meet customers’ expectations for innovative, high-quality ways to pay and be paid. This trend has been driven by business, financial, and government institutions. Visa has been playing a vital role in this movement by bringing its vision, expertise, and technologies to help enable multilateral partnerships.

Ukraine is considered one of the leaders in the digitalization of the economy in Eastern Europe. The launch of the Dilia Super App, with a wide range of e-services, is a leading example, with many businesses and countries now launching similar initiatives. In keeping pace with this digitalization, Visa has already launched Visa Direct in Ukraine, in partnership with 10 Ukrainian banks; Including PrivatBank, the largest bank in the country serving more than 20M customers. These partnerships are addressing the accelerating demand for fast, simple, and secure money movement and P2P transactions among citizens and SMEs. They have contributed to the popularization of electronic payment services and expanded the use of digital financial services.

“Privatbank is a market leader in Ukraine, we are constantly analyzing global digital and payment trends, providing our customers with superior services and customer experiences. Customer journeys simplification is a key priority for our mobile banking. Following customers’ expectations, Privatbank has launched simplified ways to send money transfers via mobile banking application. Now Privatbank’s users can send money transfers to anyone by simply choosing their phone number from a phone contact book in Privatbank’s mobile application. Money transfer will be instantly deployed to any card that receivers linked to their phone number. Such an enhancement has been deployed by virtue of Visa’s money transfers solution that helps to provide cardholders with a simple and secure way to send money.“

Dmytro Musienko, Board Member - Retail Business.

Uzbekistan

Uzbekistan, one of the most densely populated countries in Central Asia, is often described as the "country of young people" – more than 60 percent of the population is youth. Government and local businesses consider this characteristic in their policies and tend to implement innovative, convenient, and streamlined solutions. Ravnaq-bank was the first bank to encourage its consumers to shift to modernized P2P payment solutions, utilizing Visa Alias Directory Service. It was warmly welcomed by the population, demonstrating the growing trend of cashless payments.

“An international mobile transfer service from Visa has come to our Republic, and this makes it possible to make transfers quickly, conveniently, and safely. The technology platform of RBK-Mobile (APP) made it possible to become the first bank in Uzbekistan to supplement its own P2P transfer service with such a global solution.”

Bakhtinur Bakhtiyarovich Nurmukhamedov, Deputy Chairman of the Board. Ravnaq-bank

Going digital is at the core of every future transaction. In Latin America and the Caribbean, where cash has persistently held on, the pandemic made it clear that finding ways to transfer money quickly and safely is very important for consumers. There is a significant appetite for instant satisfaction, where the real-time person-to-person (P2P) transfer of money becomes part of everyday life, a modern way of sharing with friends and family. Consumers realize this and banks do too.

Yellowpepper, a Visa company, addressed this issue along with BBVA, Interbank & Scotiabank by launching PLIN in Peru at the start of 2020. PLIN is a mobile person-to-person transfer service, based on YellowPepper’s standardized real-time payment platform (Yepex) and its Alias Directory technology, that enables a secure and convenient way to initiate the immediate transfer of funds between customers. “PLIN” roughly translates to “snap!” and you can see why.

PLIN exists in a bank led digital payment ecosystem where customers can transfer funds in real-time, free of charge directly in their mobile banking applications using the recipients phone number as the Alias. The solution is expected to have 15 banks by the end of 2022, capturing 70% of the banked market. Over 5 million users are registered in PLIN as of today.

“PLIN is a groundbreaking project for Peruvian banks, which was born thanks to the collaboration of three majors banks in order to facilitate the interaction of more than 10 million people. In these times of health emergencies, PLIN facilitates the transfer and exchange of money, prioritizing digital channels over cash.”

Fernando Eguiluz, CEO of BBVA Peru.

“Consumer behaviors have shifted significantly with the current situation, driving digital adoption faster than ever. As customer expectations continue to change, we must reimagine and adapt to address our customer needs, and PLIN is a great example of this. We are proud to partner with other banking institutions to offer Peruvians a simple and easy way to send and receive money. This is just the beginning of PLIN, we hope that every financial institution in Peru joins this inclusive network, so we can make the product accessible for all Peruvians.”

Luis Felipe Castellanos, CEO of Interbank.

“With PLIN we are eliminating the barriers for transferring money between banks and making people’s lives easier, especially during difficult times such as these. We will continue working on features that anticipate the needs of our clients; we will do it for them, for our country and for every future.”

Miguel Uccelli, CEO of Scotiabank Peru.