Order Insight Digital

Proactive dispute resolution through cardholder self-service model.

available for use by

Issuer Banks

Regional Availability

View Details- N. America

- Asia-Pacific

- Europe

- CEMEA

- LAC

Terms

Product terms located at the end of the page.

Proactive Dispute Resolution for Cardholders

When cardholders are reviewing their card statement, confusion over if a purchase is legitimate is one of the most common occurrances. A cardholders’ first reaction when this occurs is typically to pick up the phone to contact the issuing bank, tying up valuable issuer resources in an attempt to identify this purchase and/or pursue a dispute. With digital goods purchases on the rise and currently representing almost 20% of all disputes Visa sees, the potential to see an increase in dispute volume is likely. This can be expensive, as the cost of fielding the telephone calls and working a dispute can be far greater than the purchase amount itself.

In 2016, close to 3 million disputes were due to a cardholder not recognizing a transaction.

Key Features

Address Rising Dispute Volume

By providing data elements such as the specific good(s) purchased, merchant data can be used by your customers, the cardholders, to solve many of the basic dispute issues your customer service representatives have to field today.

Reduce Costs

By empowering cardholders to answer their own questions pertaining to transaction recognition, fraud, friendly fraud and other use cases, issuers can optimize their customer support teams by limiting these low-value-add calls and provide cardholders with the data they need to solve many of their questions.

Optimal Self-Service Model

Creating and managing disputes for low-dollar digital goods purchases often times is a lose-lose situation. The Visa Cardholder Purchase Inquiry provides a mechanism for merchants and issuers to quickly resolve low-dollar, high volume disputes and create a positive impact on the cardholder experience by providing quicker resolution through a self-service model directly incorporated into the customer’s existing client experience (online or mobile banking issuer portal).

Why Use It?

VCPI provides issuers with a self-service model for their cardholders to review transaction specifics sent by participating merchants. Through API technology, issuers can integrate VCPI data directly into their online or mobile banking portal. By providing this data to your cardholders, you allow them to solve many of the basic questions that customer service representatives today must field. For example:

• "Where was this purchase made because I don’t recognize this merchant?"

• "I don’t believe I made this purchase."

• "I never received a package."

With VCPI, inquiries made by cardholders on a specific transaction will return data from the following sources:

• VisaNet Transaction Data – Data flowing through the payments authorization, clearing and settlement process.

• Third party merchant identification data – Verified third party data of merchant data/location.

• Transaction details from participating merchants – With over 200 data elements to choose from, merchants provide real-time data on detailed purchase information.

How Does It Work?

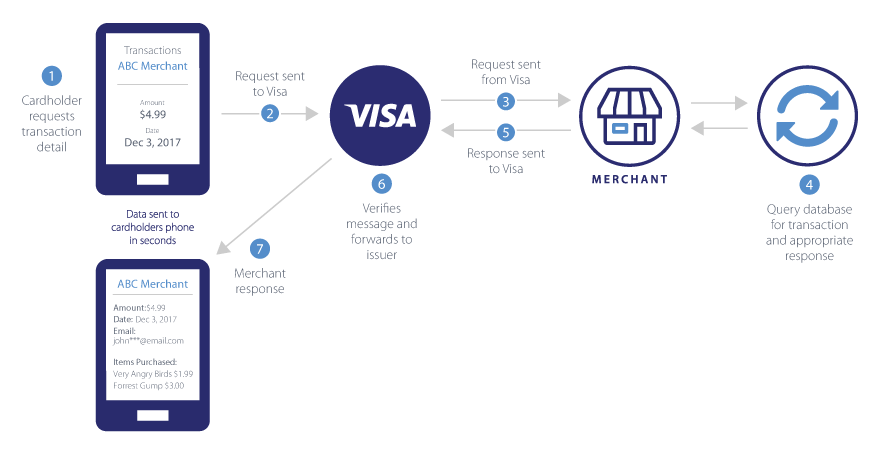

The following diagram illustrates how VCPI works.

1. Cardholder is reviewing transactions on the issuer’s online or mobile banking portal and requests additional transaction detail.

2. The issuer sends an API request to Visa for additional data.

3. If participating, Visa will send a request real-time to the merchant.

4. The merchant will query their database of transactions and return detailed response information regarding the purchase.

5. Detailed transaction information sent back to Visa in near-real-time.

6. Visa verifies the message and forwards back to the issuer.

7. Issuer presents this data to their cardholder through the online or mobile banking portal.

APIs Included

SICardholderPurchaseInquiry

Accepts a series of VisaNet data and returns detailed-level data for the returned transaction.

SIGetCardholderPurchaseInquiry

Accepts ROL Transaction ID and returns detailed-level data for the returned transaction.

Related Content

Transaction Recognition: Dispute or Legitimate Purchase?

Provide purchase details to cardholders to confirm purchases are legitimate and/or if fraud has occurred.