Visa Offers Platform.

Provides near real-time transaction data capabilities to operate card-linked programs

available for use by

Issuer Banks

Acquirer Banks

Merchants

Independent Developers

Issuer Banks for Small Business

Regional Availability

View Details- N. America

- Asia-Pacific

- Europe

- CEMEA

- LAC

Notify Visa’s Customers of qualifying Visa transactions in near real-time.

Visa’s Customers can get access to near real-time transaction data via the Visa Offers Platform to execute and manage their card-linked programs. For cardholders who have consented to take part in the Customer’s program, VOP can access the VisaNet authorization and settlement stream to qualify transactions and send the relevant notifications to the Customer in near real-time. Using the VOP APIs, Customers can leverage capabilities to enhance their own web and mobile applications.

Key Features

Enables card-linked programs based off merchant categories, named merchants, merchant locations, e-commerce, and more

Enables statement credit functionality (i.e., cashback rewards) to cardholders based off qualified Visa transactions

Provides access to qualified Visa transaction data for consented and enrolled cardholders

Why Use VOP?

Enhance the customer shopping experience:

By associating benefits to qualified transactions, customers are encouraged to explore, shop frequently and increase card usage.

Near Real-time purchase verification:

Customers can send near real-time communications (SMS Text, Email, in-APP notification) to their customers based off qualified transactions.

Acquire new customers and retain loyal customers:

Merchants can utilize card-linked programs for acquisition or retention campaigns. These may include (but are not limited to):

- providing benefits to their loyal customers.

- adding seasonal promotions to their customers.

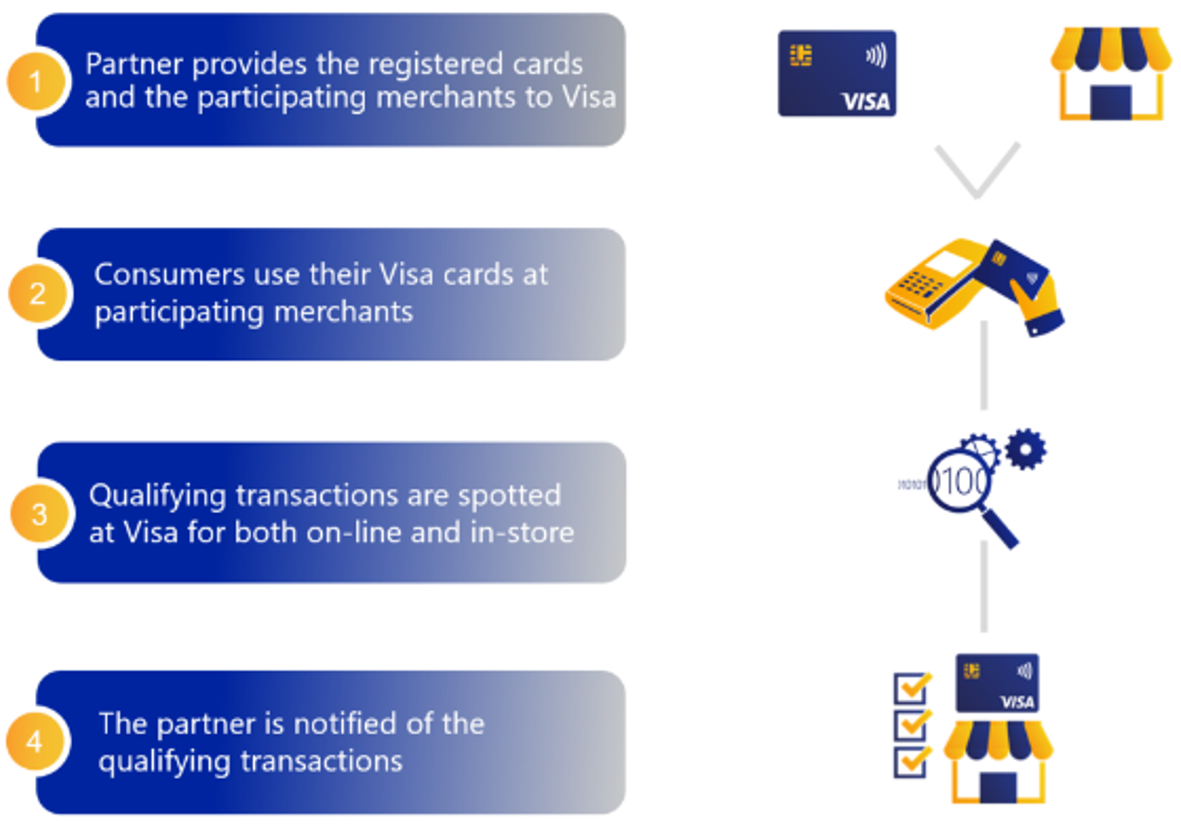

How Does VOP Work?

Visa Offers Platform provides Customers the ability to receive qualified transaction information for consented and enrolled cardholders, based on predefined rules.

In providing the service, VOP retrieves data from the VisaNet authorization stream to monitor enrolled cardholder/consumer transactions in near real-time and sends the relevant notifications back to the Customer.

Note: The VOP platform operates on a consent-based model where VOP services can only be provided to Customers who are operating their program based on explicit cardholder consents, and (if applicable) merchant consents.

APIs Included:

Users API: The Users API allows Customers to enroll their consented cardholders/customers to Visa Offers Platform, so that they can receive information based-on the cardholder’s qualifying transactions. The API also allows the Customer to manage cardholder’s profile by adding or removing cards from their profile, as per the cardholder’s consent.

Merchants API: The Merchants API allows Customers to add merchants to the Visa Offers Platform in-order to execute card-linked programs with the participating merchants. NOTE: Programs can also be executed without merchant participation.

Offers API: A construct defining a collection of qualifying transactions in a data stream is referred to as an Offer. The Offers API allows Customers to create subscriptions to the cardholder transaction data. This API also allows the Customer to stop and start the data for cardholders, based on cardholder’s consent.

Rewards API: The Rewards API allows Customers to issue statement credits to the cardholders for making qualifying purchases.

To access the Full API reference, please contact [email protected], or your Visa representative.

APIs Included

Merchants API

The Merchants API allows clients to add merchants to the Visa Offers Platform community and participate in the Visa Offers Platform program.

Offers API

The Offers API allows clients to create new offers in the system. Offers API also allows clients to activate and deactivate offers for customers in order to track qualified transaction activity.

Users API

The Users API allows clients to enroll their customers so they can receive information based on the transaction activity. The API also allows the customers to manage their profile by adding and removing cards from their profile.

Rewards API

The Rewards API allows clients to issue statement credits to the customer for qualified transactions.