Visa Account Updater

Helps sellers reduce the risk of declined transactions from account changes

available for use by

Issuer Banks

Acquirer Banks

Issuer Banks for Small Business

Regional Availability

View Details- N. America

- Asia-Pacific

- Europe

- CEMEA

- LAC

fees & terms

Free to use in Sandbox. Contact for Production fees. Product terms located at end of the page.

Secure Exchange of Account Updates

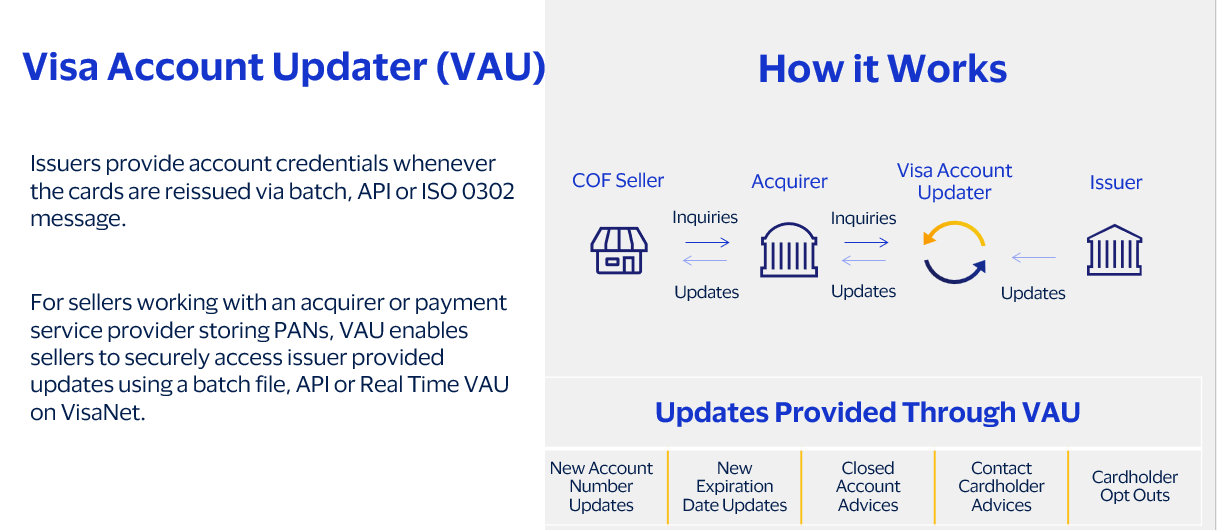

Visa Account Updater (VAU) enables a secure electronic exchange of account information updates between participating Visa card issuers and acquirers for credential-on-file merchants, which enables a more seamless payment process.

When participating issuers re-issue cards, they submit the new account number and expiration date to VAU. Issuers also provide whether an account is closed or a card holder has opt-out out. Participating merchants through their acquirers send inquiries on their credentials-on-file to VAU and are provided with updated card information, if available. This helps participating issuers retain cardholders by maintaining continuity of their payment relationships with participating merchants.

Key Features

Provide up-to-date information on merchants that request your cardholder's updated card information.

Enable you to deliver a better customer experience.

Supports multiple channels Batch, API, ISO 0302 for Issuers and Batch, API, Real Time VAU and Push Subscribe Service for Acquirers

Why Use It?

Out-of-date COF details significantly impact customers and merchants when transactions are declined. VAU enables credential-on-file merchants to securely access updated account information, facilitating a more seamless payment process and helps merchants reduce the risk of declined transactions.

It impacts Customer Experience:

- Frustration with payment experience

- Takes too much time to update

- Fees for late/declined payments

- Service delays and/or cancellation

It benefits Issuers

- Maintains top of wallet

- Simplifies portfolio management and changes

- Seamless cardholder experience

- Updates shared with Visa Token Vault

It impacts Merchants:

- Loss of customers

- Damage to brand reputation

- Decreased revenues

- Increased operational costs

It benefits Acquirers

- Strengthens relationship with merchants

- Service offering differentiator (value-added service)

How Does It Work?

Issuer sends account updates to VAU. Sellers through their acquirers sends "inquiries" prior to the cardholder billing cycle. VAU processes inquiries against issuer updates and sends response to acquirers who then update their/seller billing system.

APIs Included

Visa Account Updater Issuer Stop Advice API

The VAU Issuer Stop Advice API is a secure, scalable, and high-performance web service/API for issuers and issuer processors to send VAU requests to place stop advice to prevent updates for specific cardholder PAN(s) and merchant(s) combinations from being shared.

Visa Account Updater Acquirer API

The VAU Acquirer API enables acquirers, processors for merchants to submit VAU inquiries and receive real time updates with information from the VAU database.

Visa Account Updater Merchant Enrollment API

The VAU Merchant Enrollment API allows an acquirer to enroll up to 100 merchants in one API call / request eliminating the need to call repeatedly. This would speed up the enrollment process.

Visa Account Updater Merchant Search API

The VAU Merchant Search API is a complementary API to Merchant Enrollment API built to check the updated status for those merchants where initial response to enrollment was “In-Progress”. This API can also be used to check the enrollment status of the merchants.

Push Subscribe Service

VAU Push Subscribe is a new channel that complements existing VAU methods such as batch, API, and Real Time VAU. It offers the advantage of speed and efficiency by proactively delivering credential updates (“push”) when they change, rather than requiring acquirers to request for updates. These APIs are available to support any acquirers enrolled in VAU. This service is optional.